San-Ku Gaps

Trading the Three/Triple Gap Pattern

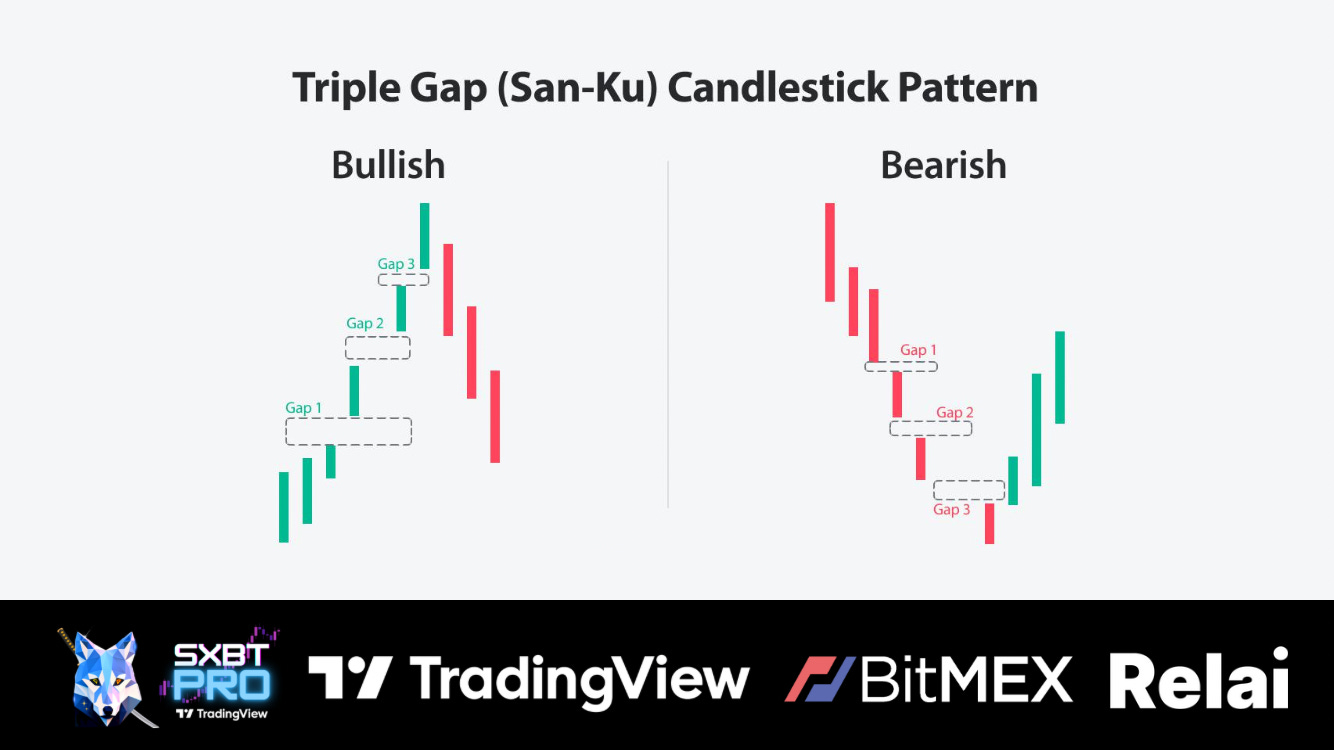

The San-Ku, also known as the Three Gap or Triple Gap pattern, is a technical pattern to identify potential trend reversals. It appears on price charts and signifies a significant shift in market sentiment.

Here's how to recognize a San-Ku pattern:

Three Gaps: It consists of three consecutive gaps, either upwards or downwards, within a well-defined existing trend. These gaps represent empty spaces between price bars, indicating a lack of trading activity at those price points.

Upward vs. Downward:

A bullish San-Ku has three upward gaps, suggesting a potential upward trend reversal.

A bearish San-Ku has three downward gaps, suggesting a potential downward trend reversal.

Interpretation:

The three gaps in the San-Ku pattern indicate a sudden and forceful movement in price, potentially signaling that the current trend is losing momentum and might be reversing.

The gaps can also suggest that buyers (for bullish patterns) or sellers (for bearish patterns) are entering the market aggressively, pushing prices higher or lower.

Trading with San-Ku:

Trend Reversal Signal: Traders may use the San-Ku pattern as a cue to enter a trade in anticipation of a trend reversal. For instance, a bullish San-Ku might prompt a long position (buying) expecting prices to continue rising. Conversely, a bearish San-Ku might lead to a short position (selling borrowed shares) expecting prices to fall.

Confirmation: It's crucial to remember that the San-Ku pattern is not a foolproof indicator. Traders often look for confirmation from other technical indicators or chart patterns before acting on a San-Ku signal.

Important Considerations:

False Signals: San-Ku patterns can sometimes be misleading and lead to false breakouts. Prices might gap in one direction but then reverse course and continue the original trend.

Volume: For a stronger signal, look for the San-Ku to be accompanied by increased trading volume. This signifies more significant market participation behind the price movement.

By understanding the San-Ku pattern and its limitations, you can potentially identify potential trend reversals and make more informed trading decisions. Remember, it's always wise to use a combination of technical analysis tools for better trade confirmations.